Introduction :

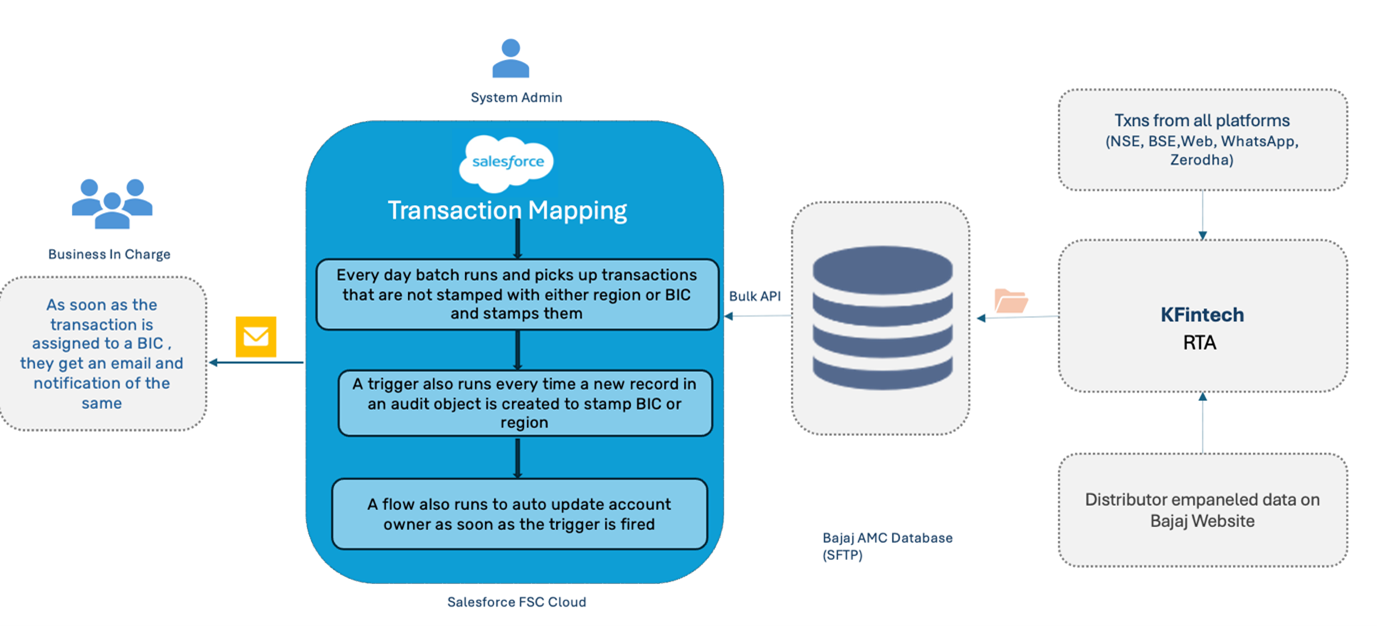

The automated stamping system ensures accurate BIC and region details on transaction records, reducing errors and improving data quality. It automates the process, saving time and effort for employees. The system can handle various scenarios and scales to accommodate increasing transaction volumes. Additionally, it provides a clear audit trail and enhances customer experience by ensuring accurate transaction processing.

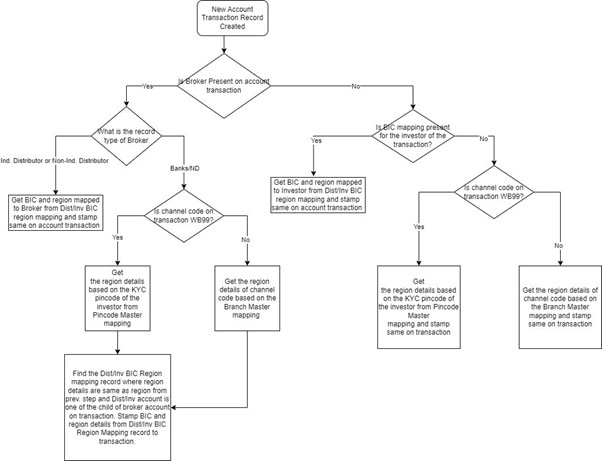

This is a visual architectural representation of how the module works:

Fig.1 : High level Solution Architecture diagram

Business challenge:

- Handling Different Broker Types and Transaction Channels

- The company worked with various brokers and processed transactions through multiple channels, leading to inconsistent procedures and data management challenges.

- Ensuring Accurate Data Stamping Across Transactions

- Manual data entry led to errors and inconsistencies, and the lack of real-time validation contributed to data quality issues.

- Scaling Transaction Volumes While Maintaining Data Quality

- The growing volume of transactions made manual processing challenging, leading to resource limitations and increased risk of errors.

- Calculating the Correct Business Split Based on Region

- Inconsistent region mapping led to discrepancies in data traceability and potential impacts on revenue recognition

Technical Solution/Flow –

Solution:

Different scenarios that were implemented-

Scenario 1 :

BIC Leaving the Organisation - If new BIC has been appointed then all the accounts should get mapped to new BIC, and all transactions that had happened till transfer date will remain with old BIC.

Scenario 2 :

BIC moving to a different location –

- If Distributor wants to continue with the BIC even if moving to a different location, then business done until the date should remain with Region 1 and after location change, any new transaction should start showing with Region 2.

- If Distributor doesn't want to continue and wants a new BIC and if BIC is appointed, then all accounts should be mapped to new BIC or else should be mapped to Reporting Manager and all transactions till transfer date should remain on old BIC’s name.

- If BIC moved to different location and accounts were not transferred till new BIC came in, then any transaction happened in that period can be claimed by the new BIC or Reporting Manager so that business gets allocated to the appropriate Region.

- If the Cluster of BIC gets increased, then there will be new accounts that will get mapped to the BIC. In this scenario, all transactions done by previous BIC will remain with previous BIC.

Scenario 3 :

Account Transfer Happening –

- If Account gets transferred from one BIC to another BIC and is outside the Region, then all old transactions should remain with Region 1 (Old BIC) and any new transactions coming in should be mapped to Region 2 (New BIC).

- If Account gets transferred from one BIC to another BIC and is within the Region, then all old transactions should remain with Old BIC and any new transactions coming in should be mapped to New BIC.

- If RBH or CM is transferring the account to BIC within the Region, then all the transactions from date it was with RBH or CM should be mapped to the BIC.

Scenario 4 :

Sub-Broker Mapping - If there are Sub-Brokers doing transactions using Parent ARN, then we map transactions exceptionally to BIC claiming them and show an Adjustment table on Parent ARN where BIC of parent ARN is able to identify business brought by other BIC.

Scenario 5 :

Adjustment Table - If transfer happened, then we start showing the adjustment table so that BIC owing the account is aware that out of the Total AUM there is adjustment that needs to be considered so that BIC gets to know the actual business done by him.

Impact:

The implementation of the transaction mapping solution had a transformative impact, yielding substantial improvements across various operational metrics.

- Data Accuracy: 70% improvement, leading to better decision-making and reduced errors.

- Distributor Relationships: 40% strengthening due to improved communication and coordination.

- Sales Cycle Time: 50% reduction, allowing for faster deal closure and increased responsiveness.

- Sales Team Productivity: 50% increase, enabling more efficient resource allocation and improved customer satisfaction.