Introduction :

A leading Indian Non-Banking Financial Company (NBFC) faced a pressing need to modernize its life insurance sales processes. Traditional, manual methods were creating inefficiencies and hindering the company's ability to meet the growing demand for personalized, flexible insurance products. Customers were increasingly frustrated by the lack of transparency and speed in the purchasing process.

To address these challenges, the NBFC partnered with Salesforce to develop a robust, customer-centric quoting platform. This transformation aimed to streamline operations, automate manual tasks, and offer instant life insurance quotes to customers, ultimately improving both internal efficiency and the customer experience

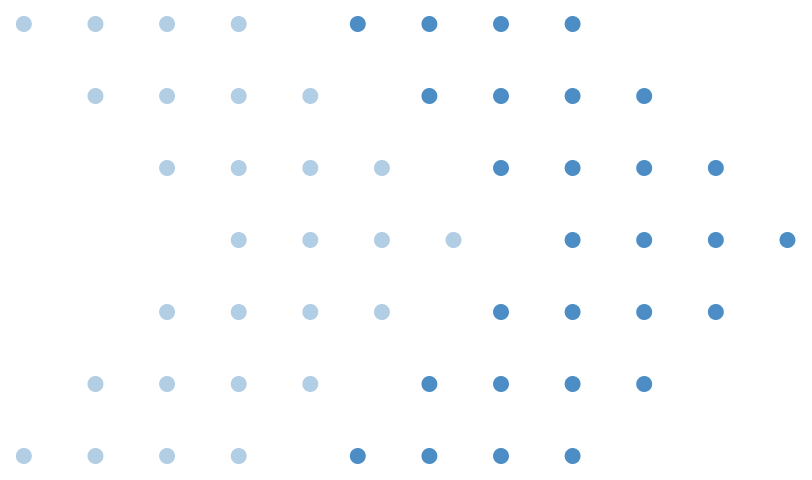

Fig.1 : Insurance Quote Process Flow

Above Diagram shows the stages that a customer will go through to get his/her quote and benefit illustration pdf.

Business Challenge:

The NBFC encountered several critical challenges in its life insurance sales process, which hindered growth and operational efficiency:

- Lack of Digital Capabilities : The company relied on outdated, manual processes for quoting, leading to errors, inefficiencies, and customer frustration.

- Opaque Pricing : Opaque pricing and a lack of clear information led to customer dissatisfaction and complaints.

- Visibility and Control : Limited visibility over riders and add-ons hindered the company's ability to provide personalized solutions.

- Policy Flexibility : The lack of flexible product options, including limited availability of riders and add-ons, restricted customers’ ability to customize their insurance policies. This limitation reduced the company’s ability to cater to diverse customer needs, preventing potential sales and limiting growth opportunities.

The NBFC's reliance on manual processes, lack of transparency, limited product options, and customer-centric solutions hindered efficiency and satisfaction. A digital transformation was necessary to address these challenges and drive future growth.

Solution

The implementation of Salesforce's Financial Services Cloud and Sales Cloud enabled the NBFC to achieve a comprehensive digital transformation through the following key enhancements:

- End-to-End Quoting Platform : The new Salesforce-based system facilitated the provision of instant life insurance quotes, significantly improving efficiency in the quoting process. This platform streamlined the workflow by integrating product variations, rider selection, and add-on options into a single, cohesive system, allowing sales representatives to quickly tailor quotes to individual customer needs.

- Multi-Product Refinement : With the updated system, customers were presented with a variety of product configurations, including various add-ons and riders. This flexibility ensured that clients could customize their insurance policies according to their specific requirements, enhancing customer satisfaction and making it easier for the sales team to meet diverse client needs.

- Automated PDF Generation : The Salesforce solution incorporated an automated Benefit Illustration (BI) PDF generation engine, which created detailed, customized illustrations for each iteration of the quote. This automation minimized manual errors, ensured accuracy, and improved the overall quality of documentation provided to customers, fostering better understanding and trust.

- Communication Enhancement : The integration of email communications within the system featured pre-built templates and options for document attachments. This enhancement improved customer interactions by providing clear updates and transparent communication throughout the quoting process, allowing for a more engaging and informative experience for clients.

These enhancements collectively transformed the NBFC's operations, enabling it to provide a more efficient, transparent, and customer-centric insurance sales process.

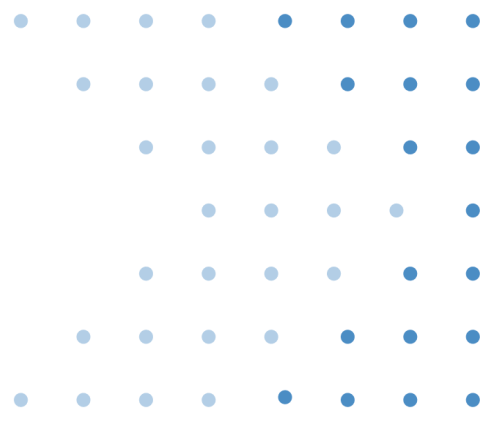

Below Diagram explains the process of a customer getting issued with his/her quote and benefit illustration.

Impact :

The implementation of the new Salesforce-based insurance quoting system resulted in substantial enhancements in both operational efficiency and customer satisfaction for the NBFC, driven by several key improvements:

- Increased Efficiency : The automated quoting platform significantly streamlined operations, reducing manual tasks and accelerating the quoting process. This led to quicker turnaround times and improved customer satisfaction

- Quick Download of Benefit Illustration : The platform enabled quick downloads of Benefit Illustrations, enhancing transparency and customer understanding. This reinforced trust and improved the overall customer experience.

- Frictionless Customer Experience : The platform offered a seamless customer journey with integrated payments and simplified KYC checks, fostering greater customer loyalty and encouraging referrals.